CFD products are complex leveraged products that carry a high risk of loss of all invested amounts. Ensure you fully understand the risks involved. Please read our Risk disclosure document.

CFDs are complex, leveraged products and carry a high risk of loss.

- Trade

- ForexNavigate the pulse of international finance and currency trading.

- CommoditiesTrade essential commodities, from energy to agriculture and more.

- IndicesTrack the market’s momentum and trade key indices that shape the global economy.

- StocksExplore industry leaders and access the world’s top companies in one platform.

- CryptocurrenciesUnlock digital innovation and dive into the crypto markets.

- MetalsAdd timeless value to your portfolio and trade gold, silver and other prized metals.

- Swap FeesGet the full picture on overnight costs and see how they impact your trading positions.

- CFDs ListAccess our complete selection of tradable CFD markets.

- CFDs ExpiriesTrade smart and track expiration dates to manage your CFD positions effectively.

- Market HolidaysStay in sync by knowing when global markets pause so you can plan your strategy.

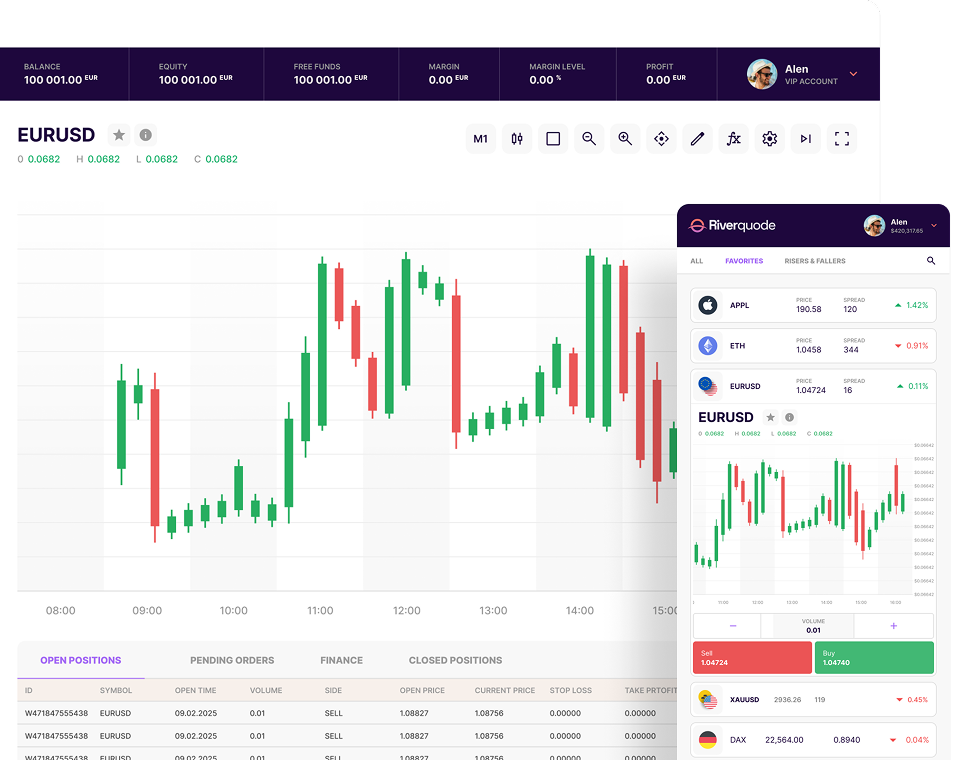

- webtrader

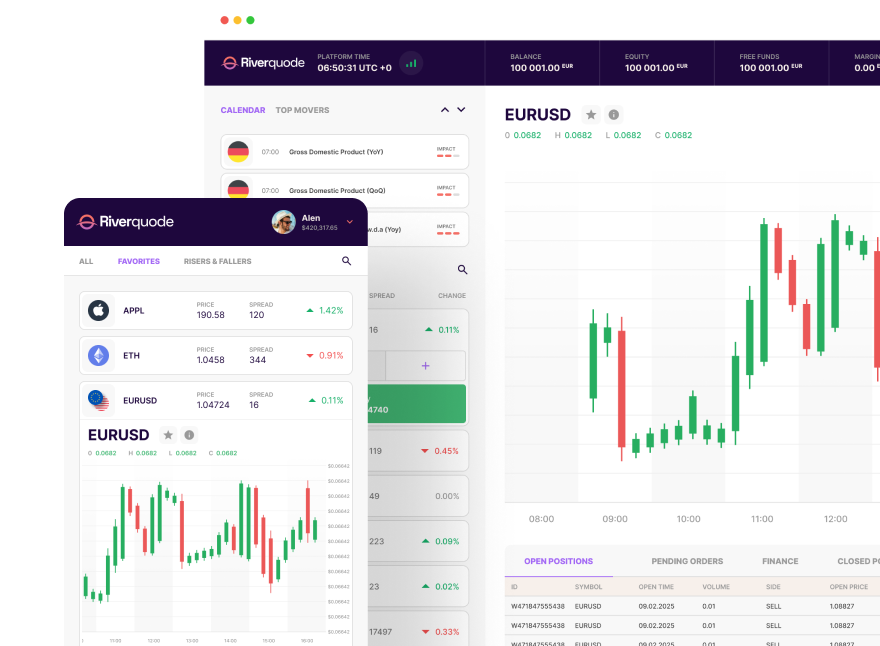

WebTrader

Licensed and Regulated

Trade from anywhere with ease and access powerful tools in a sleek web-based platform.

Install the Riverquode app

Get the Riverquode app

- Accounts

Classic AccountA refined option that offers more control for traders ready to take the next step.

Classic AccountA refined option that offers more control for traders ready to take the next step. Silver AccountPerfect for traders looking for greater flexibility and sophistication.

Silver AccountPerfect for traders looking for greater flexibility and sophistication. Gold AccountTrade with precision, crafted for ambitious traders ready to elevate their game.

Gold AccountTrade with precision, crafted for ambitious traders ready to elevate their game. Platinum AccountAchieve peak performance, tailored for experienced traders who expect more.

Platinum AccountAchieve peak performance, tailored for experienced traders who expect more. VIP AccountExperience elite trading and premium features. Ideal for those who demand the very best.

VIP AccountExperience elite trading and premium features. Ideal for those who demand the very best.

- Resources

- Trading CoursesLearn step by step with structured courses designed to take you from beginner to confident trader.

- E-BooksBoost your trading knowledge with in-depth resources you can read and learn from at your own pace.

- SignalsGain a market edge with real-time insights and actionable trade ideas delivered straight to you.

- Knowledge HubFind quick answers, useful guides, and expert support for everything related to trading.

- Platform TutorialsQuick and powerful platform insights through expertly crafted tutorials.

- GlossaryUnderstand trading terms with ease using our quick-reference guide to key market vocabulary.

- Education CenterYour all-in-one destination for building a strong foundation in trading skills and strategies.

- Trading CentralExplore the markets with expert insights, strategic trade ideas, and valuable guidance for smarter decisions.

- Chart AnalysisUnderstand market behavior by identifying patterns and trends to enhance your technical trading skills.

- Economic CalendarStay up to date with important economic events and announcements that can impact the financial markets.

- Risk Management ToolsTake control of your trading with tools designed to help you manage risk and protect your investments.

- Daily Market VideosQuick and powerful market insights-fresh videos every day.

- Latest Market NewsLive market-moving news to fuel smarter trading decisions.

- Help Center

Want to know more?

Visit our Knowledge Hub

Find quick answers, useful guides, and expert support for everything related to trading.

- Company

- Reviews

Riverquode’s support team is excellent. I had an issue with my withdrawal request, and they resolved it within hours. Very satisfied.

Lina M.Saudi Arabia

4.9★★★★★

Rating

The trading platform is simple and intuitive. I’m not very tech-savvy, but I found it easy to place trades, manage my portfolio and use the charting tools. Great design!

FedericoArgentina

4.7★★★★★

Rating

Opening an account with Riverquode was straightforward. Verification was quick and I was able to start trading the same day. The process was smooth compared to other brokers I tried.

Pedro M.Brazil

4.8★★★★★

Rating

The spreads are very competitive and I’ve noticed fast execution on my trades. No major slippage so far, even during news events. Perfect for day traders like me.

Long L.Singapore

4.9★★★★★

Rating

I like how easy it is to fund my account. Deposits reflect instantly and my first withdrawal came through in just 24 hours. This builds a lot of trust.

Anurak K.Thai

4.7★★★★★

Rating

Riverquode offers a lot of useful materials for beginners. The webinars and tutorials helped me understand strategies better. It’s a broker that actually cares about trader growth.

Amira F.Malay

4.8★★★★★

Rating

- AI Trading

Already have an account? Login

Already have an account? Login